In March 2019, the Thai government introduced the new Land and Building Tax Act B.E. 2562, which has been in effect since January 1, 2020.

The Act obligates individuals, corporate entities, or any beneficiaries of land or buildings, to pay land and building tax. The new law replaces several legislations which include – the Land Tax of 1932; the Land Development Tax of 1965; the Notification of the National Executive Council No. 156 of 1972; and the Royal Decree Designating the Medium Price of Land for Land Development Tax Assessment of 1986.

Find Business SupportThe tax rates on properties were previously assessed on an income-based method. The Act replaces this method with an assessment based on the property’s appraised value, as determined under the current Land Code.

The tax will be applied to the following categories of property:

Through these latest changes, the government hopes to introduce a progressive tax system, encourage landowners to utilize their land, and help reduce the overall tax burden on property owners. The tax payments will be due in April of every year.

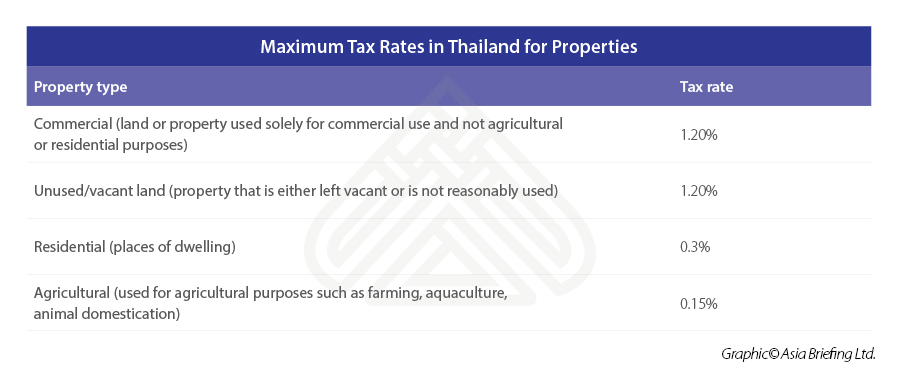

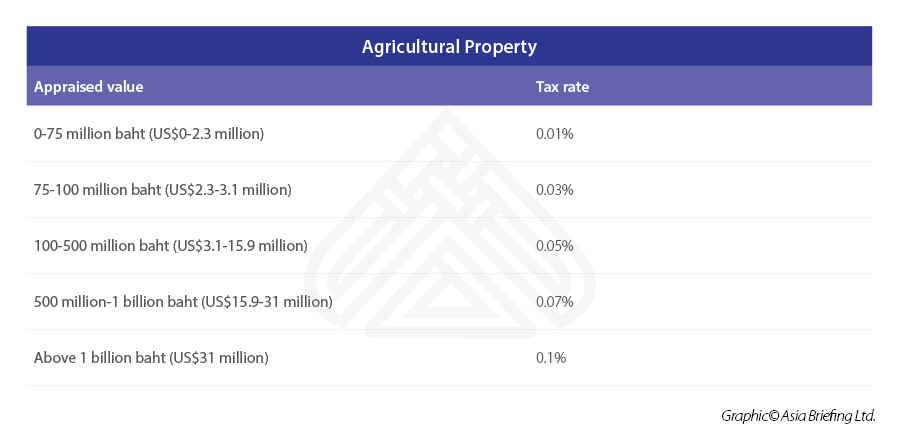

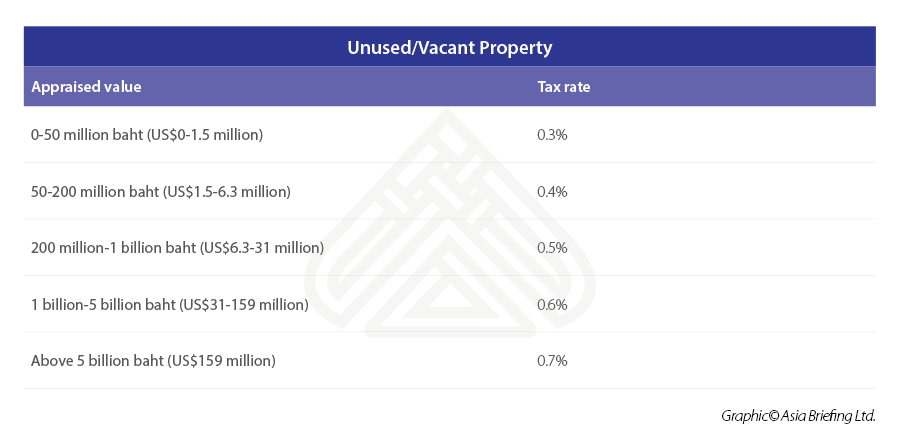

The Act sets a ceiling tax rate for the different categories of property.

Readers should note that if a property remains vacant for more than three consecutive years, the rate will be increased by 0.3 percent every three years until it reaches a cap of three percent.

Property owners can be exempted from the land and building tax if they fall under the following categories:

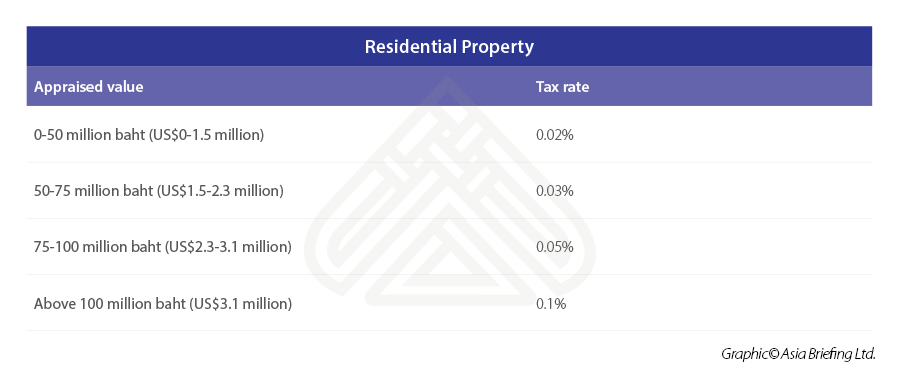

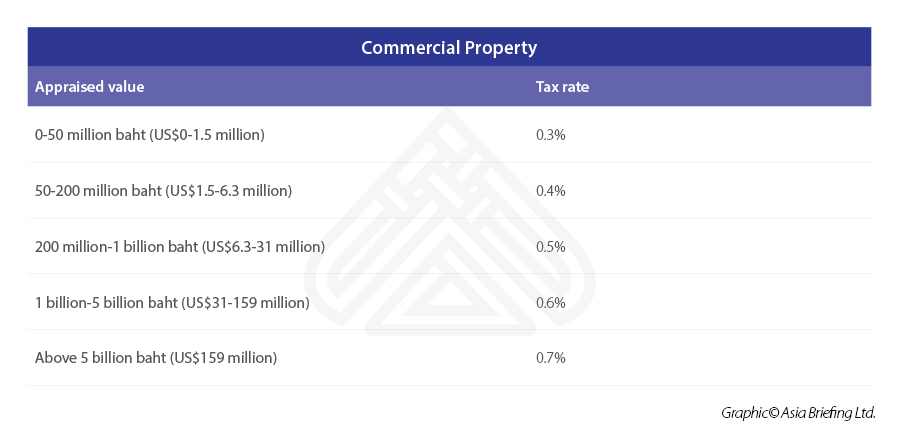

The Act provides a two-year transition period, starting January 1, 2020, to allow property owners to adjust to the new law. During this period there will be a reduced tax rate. This can be seen from the following tables.

There are further tax deductions in the broad tax deduction clause of the Act. To qualify, property owners should fulfil certain criteria:

The government is estimated to collect 39.4 billion baht (US$1.2 billion) from land and property tax in 2020.

About Us

ASEAN Briefing is produced by Dezan Shira & Associates. The firm assists foreign investors throughout Asia and maintains offices throughout ASEAN, including in Singapore, Hanoi, Ho Chi Minh City and Jakarta. Please contact us at asia@dezshira.com or visit our website at www.dezshira.com

Our free webinars are packed full of useful information for doing business in ASEAN.